- India

- International

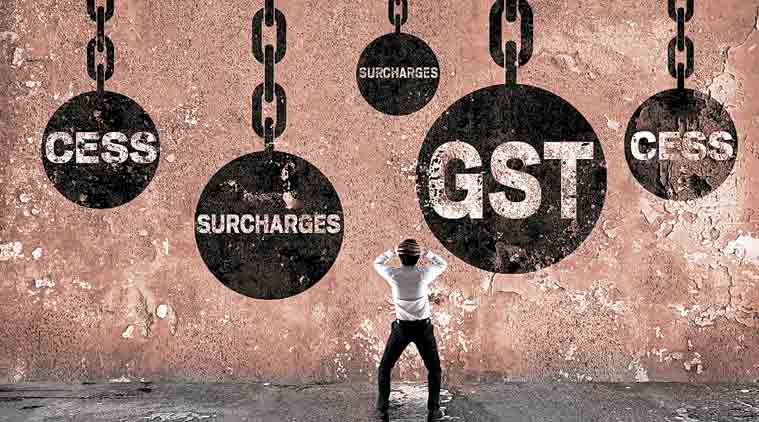

CBEC to be renamed as CBIT under GST regime

The government plans to implement the new indirect tax regime goods and services tax (GST) from April 1, 2017.

A revenue department official said the organisational structure of GST is being worked out and CBEC will be renamed.

A revenue department official said the organisational structure of GST is being worked out and CBEC will be renamed.

Apex indirect tax body CBEC will be renamed as the Central Board of Indirect Tax (CBIT) once the new national tax framework kicks in from April 1 next year, as per the draft dealing in GST organisational structure prepared by the Centre.

Headed by a secretary-level officer, CBIT will implement the rules, including exemptions and threshold, to be set by the GST Council, which is chaired by Union Finance Minister and has state finance ministers as its members.

The government plans to implement the new indirect tax regime goods and services tax (GST) from April 1, 2017. GST will subsume central excise, service tax and other local levies, including VAT and octroi.

A revenue department official said the organisational structure of GST is being worked out and CBEC will be renamed.

To give effect to this, the Centre is reworking the composition of the Central Board of Excise and Customs (CBEC) to make it more comprehensive.

CBIT will consist of six members, who will look after Customs, policy and IT, central excise and legal issues, training and litigation.

Besides, an additional secretary of the department of revenue, who will be secretary to the GST Council, will be a CBIT member for Central GST (CGST) and Integrated GST (IGST) related matters.

Besides, a new legacy commissionerate will be formed for the initial 5 years to handle pending adjudication, audits, legal issues and the like.

As per the draft blueprint, the entire country will be divided into six regions — northern, southern, eastern, western, north-eastern and central — and will be headed by a principal commissioner-level officer.

The regions will then be divided into zones putting certain states together and each zone will be headed by a chief commissioner. Every state will then be divided into smaller chunks termed as GST Range so that there are 1,000 assessees in a range.

On the draft GST administrative structure, Nangia & Co Director (indirect taxation) Rajat Mohan said the government is moving ultra-fast to meet the deadline of GST of April 1, 2017.

“The blueprint for laying down the transition of administrative mechanism is out and it would help the officers and bureaucrats now know the roles and responsibilities of various positions under the GST regime. Accountability and answerability of officers are also fixed depending on their positions and cadre,” Mohan said.

As per the structure, the Directorate General of Central Excise Intelligence (DGCEI) will be rechristened as DGITI (Directorate General of Indirect Tax Intelligence).

Since the tax base in the GST set-up is bound to increase manifold, the challenge will be to provide maximum facilitation and at the same time ensure optimum compliance. In this context, the role of DGITI will be of paramount significance.

“It would be the country’s premier intelligence agency to handle economic frauds and offences related to taxation. DGITI should have a pan-India presence. The organisation shall be headed by an officer of DG rank. Every state should have regional units headed by an ADG-rank officer. Officers having expertise in VAT laws from state administration may be deputed to DGITI,” read the draft.

Also, a position of DG, Risk Management Centre (RMC), is proposed to be created and headed by a senior officer of the rank of director general.

RMC shall identify, develop, update and maintain risk parameters in relation to trade, commodities, services and all stakeholders in the domestic supply chain. It will have a strong data analysis unit to ensure seamless flow of data and information from agencies within and outside the central and state tax administration.

RMC will also carry out research and study best practices, provide training to field officers and offer inputs for non-intrusive methods of investigation such as risk-based auditing and scrutiny.

The long-pending GST Constitutional Amendment Bill was passed by Parliament last month. President Pranab Mukherjee last week gave his assent to the Bill, thus paving the way for creation of the GST Council.

According to sources, the Union Cabinet will next week consider the proposal of setting up the Council following which it will be notified. The Council will take key decisions relating to GST rate, exemptions and threshold.

Apr 18: Latest News

- 01

- 02

- 03

- 04

- 05