Billionaire KP Singh to make DLF debt-free, will infuse Rs 10,000 crore

The Singh family plans to sell its 40% stake in DLF Cyber City Developers for Rs 12,000-13,000 crore and will use the money to retire the parent company’s debt.

NEW DELHI: Billionaire KP Singh and his family have decided to wipe out DLF Ltd’s debt in a two-step transaction. They will pump Rs 10,000 crore into India’s largest real estate developer by purchasing shares in a preferential issue with funds raised from the sale of their stake in the company’s rental unit.

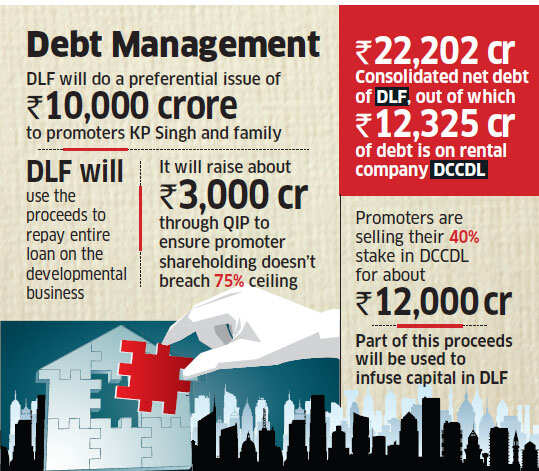

NEW DELHI: Billionaire KP Singh and his family have decided to wipe out DLF Ltd’s debt in a two-step transaction. They will pump Rs 10,000 crore into India’s largest real estate developer by purchasing shares in a preferential issue with funds raised from the sale of their stake in the company’s rental unit.The Singh family plans to sell its 40% stake in DLF Cyber City Developers Ltd.(DCCDL) for Rs 12,000-13,000 crore and will use the money to retire the parent company’s debt. Separately, DLF will raise about Rs 3,000 crore from institutional investors to ensure that the stake of the promoters doesn’t breach the 75% threshold with the purchase of the preferential shares, said two people familiar with the development.

DCCDL is 60% owned by DLF and has a debt of Rs 11,000-12,000 crore. DLF declined to comment on the matter. “Since the process is on-going, we have no comments to offer,” a spokesperson said.

DLF had a consolidated gross debt of Rs 25,623 crore as of March 2016. Net debt, after adjusting cash in hand of Rs 3,421 crore, was Rs 22,202 crore and this included Rs 12,325 crore of DCCDL’s dues. The residual debt on DLF’s books would be about Rs 10,000 crore. Singh and family are in advance discussions with sovereign and pension funds and private equity firms to sell 40% ownership in DCCDL, DLF arm that develops and leases commercial property.

“The proposed divestment in DCCDL is expected to be at an equity value of about Rs 30,000 crore and the sale of 40% stake would help the promoters in raising about Rs 12,000 crore. The deal is expected to close by August-end or September beginning,” the second person said. “The promoters will infuse about Rs 10,000 crore from the sale proceeds in DLF by way of preferential issue of shares.”

GIC of Singapore, Abu Dhabi Investment Authority, Qatar Investment Authority, Canada Pension Plan Investment Board, Blackstone Group, Temasek Holdings, Warburg Pincus and Brookfield Asset Management are among the sovereign and pension funds and PE firms that have submitted bids for the stake in DCCDL, the person said. Once promoters enter a binding agreement with the successful bidder, DLF will start the process of raising funds through the fresh issue of equity shares to the promoters and institutional investors.

COMMENTS

All Comments

By commenting, you agree to the Prohibited Content Policy

PostBy commenting, you agree to the Prohibited Content Policy

PostFind this Comment Offensive?

Choose your reason below and click on the submit button. This will alert our moderators to take actions