Growth in broadband subscriber base in India is a reason to cheer. But the growth comes with significant challenges for both broadband users and telecom network operators.

India’s broadband subscribers soared 60 percent to 136.53 million at the end of December 2015, from 85.74 million a year earlier, according to Telecom Regulatory Authority of India (TRAI).

The expected growth in India broadband market will be supported by increase in investment in wireless broadband by telecoms such as Vodafone, Airtel, Idea Cellular and Reliance Jio Infocomm. The main concerns are poor quality broadband and inadequate coverage.

Broadband growth

Among this addition in subscribers, the number of wireless broadband subscribers increased more than 70 percent, to 120.02 million, from the previous 70.42 million reported at the end of December 2014. The number of fixed-line broadband users went up to 7.76 percent over the 12-month period to reach 16.51 million at the end of December.

Bharti Airtel (31.49 million), Vodafone (25.91 million), Idea Cellular (21.21 million), BSNL (19.85 million) and Reliance Communications Group (15.41 million) stood out as the top broadband service providers, adding up to a total of 83.41 percent of the net market share of broadband subscribers in the year 2015.

As on 31 December, 2015, the top five wired broadband service providers were BSNL (9.92 million), Bharti Airtel (1.67 million), MTNL (1.12 million), Atria Convergence Technologies (0.86 million) and YOU Broadband (0.51 million).

Top five wireless broadband service providers were Bharti Airtel (29.82 million), Vodafone (25.91 million), Idea Cellular (21.21 million), Reliance Communications Group (15.30 million) and BSNL (9.93 million).

Poor broadband usage

Despite the increase in the number of broadband subscribers, India is still not par with other nations when it comes to broadband and data usage. In the ITU 2015 State of Broadband Report, India was ranked 131 out of 166 nations with respect to internet usage, ranking even under Sri Lanka and Bhutan. Also, India was categorized within the distinctive class of 42 least connected countries, with 11 countries from Africa ranking above it. TRAI has hence suggested that the need to improve data usage and broadband.

Optical fiber essential for broadband development

In times when sustainability in broadband and telecom cannot be achieved without fiber, India lacks in broadband technology due to insufficient optic fiber deployment all over the country. Though there is increase in wireless network and adequate and robust mobile networks have been made available, India is still at great disadvantage when compared to the likes of US, Europe, China, etc., who are leading in the broadband technology at present. This drawback has to be overcome in order to aid the Broadband for All and Digital India initiatives which demand large data back-haul capacity, which is very huge than the limits of most microwave solutions.

BharatNet under implementation

In spite of the government having sanctioned the National Optical Fiber Network (NOFN) project with a budget of Rs 20,000 crore four years back, ineffective design and poor implementation resulted in very small progress in a time period of the previous four years, backed by relaxed deadlines, hence leading to the project being dropped in 2015. TRAI has instead announced, in April 2015, a revised group of recommendations for Delivering Broadband Quickly and has launched a comprehensive Consultation Process for Implementation of BharatNet, the new name of NOFN.

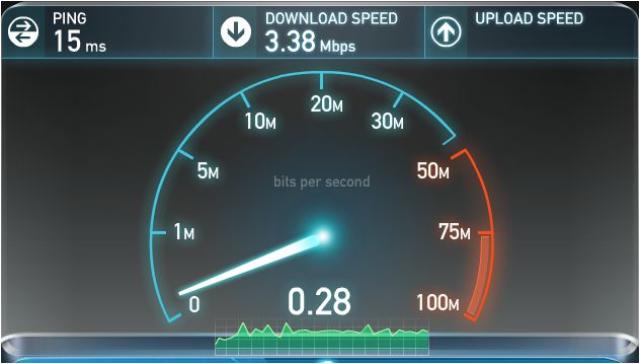

Broadband speed needs to be upped

India has the slowest average of Internet speeds in Asia Pacific, ranking 116th globally. India had an average of 2.5 Mbps Internet speeds in 2015, whereas South Korea has the highest speeds at 20.5 Mbps in the region. Though the average comes to 2.5 Mbps, TRAI’s definition for broadband is as low as 512 Kbps. India was raised from 256 Kbps under the National Telecom Policy 2012. The regulator had earlier planned to raise the speed up to 2Mbps by January 2015 but failed. With consumers using more data there is a huge requirement for better quality of service from telecom operators. For broadband 512 Kbps is very slow and is not practical with respect to the present user’s data usage.

The regulator is attempting to step up its efforts to redefine the broadband speed to at least 2Mbps. Telecom operators and ISPs, who are already struggling to deliver seamless 3G and 4G speeds to users, may be unwilling to accept the change because it will add to their pressure of ensuring better quality of services.

As a start to solving this challenge, TRAI has asked fixed broadband operators to share details of tariff plans on their websites, including data usage limits and connection speeds — both up to the specified usage levels and beyond. It has also urged fixed broadband operators to ensure download speeds do not drop below 512 kbps in any broadband tariff plan.

Also, TRAI has given its final set of recommendations for implementation of BharatNet with all-round acceptance received for it suggesting that TRAI would give Project BharatNet a boost and help achieve Broadband for All.

BOOT Model and RoW recommended by TRAI

TRAI has also recommended BOOT model with involvement of the private sector for deployment and operations, with experts having the opinion that the investment should be predominantly made by the government in order to ensure open, non-discriminatory access to all operators, keeping in view the size, complexity, and associated risks involved.

TRAI has also announced that RoW (Right of Way) must be provided free of cost by all states to the executing agency, which is a fundamental requirement for fiber implementation and other TRAI recommendations.

Revenue expectations

If the above TRAI recommendations are implemented, the revenue expected from broadband services by 2020 can go up to of 1 lakh crore rupees. The revenue potential can even beat this estimate as the broadband potential has been recognized to be huge in India.

Broadband revenue mainly depends on the availability of content, affordable handsets, and user-friendly government regulations and policies. BharatNet, a significant part of Digital India, can be a potential GDP multiplier, equivalent to up to 2-4 times the $18 billion that is proposed to be invested in Digital India, and is believed to be able to add between $36 billion and $72 billion to India’s GDP in the coming years.

In 2014-15, the government had earned revenue of Rs 1.1 lakh crore from spectrum auction. TRAI has given its recommendation in January this year on auction for spectrum in various bands — including the premium 700 MHz for the first time, with the highest reserve price ever at a reserve price of Rs 11,485 crore per MHz.

The 700 MHz band is suitable for mobile broadband and fourth-generation (4G) technology services. It is much sought after for long-term evolution deployment around the world, due to its efficiency and higher penetration inside buildings. But some of the existing operators are currently opposing the auction of 700 MHz implying that the price set is high. The auction is set to commence by June-July.

Major Concerns

The main concerns that TRAI is dealing with at the moment include maintaining quality of service parameters, licensing conditions and infrastructure, making spectrum available for commercial purpose, and providing customers with better services at lower cost. With telcos getting more spectrum through the last auction and through trading and being able to re-calibrate their networks/frequencies over a period of time, the Quality of Service seems to be an important parameter that has to be regulated.

The government/regulator has put in efforts in the same by forcing telcos to invest more in fixing their networks with the TRAI regulation that has mandated them to pay subscribers Re 1 for every call drop they experience on their network, subject to a cap of three call drops a day, starting from January 1, 2016. The mandatory rule has not been implemented yet and is currently being challenged by the telcos in Supreme Court.

Also, the spectrum harmonization process with the defense ministry is under process, which is an effort to allocate more spectrum for commercial uses. The ministry has conveyed that it will release 3G spectrum – in the 1,800 megahertz (MHz) band – for commercial use. According to the Telecom Regulatory Authority of India (TRAI), the defense ministry will release 330 MHz out of 345 MHz, and this would be auctioned in the 2,100 MHz band (frequency).

Also, TRAI expects to finalize its view on Net neutrality in the next 2-3 months, leading to less price discrimination. Net neutrality means no discriminatory pricing and treatment by Internet service providers in terms of applications and content that are carried through them. Concerns such as throttling of Internet speed, regulatory framework for Net-based calling and messaging applications are still waiting to be addressed by the regulator.

Vina Krishnan

[email protected]