- News

- Business News

- India Business News

- Standard Chartered Bank posts first global loss in 26 years on $1.3bn India hit

Trending

This story is from February 24, 2016

Standard Chartered Bank posts first global loss in 26 years on $1.3bn India hit

A $1.3-billion (Rs 9,781-crore) hit taken by Standard Chartered Bank on its loans in India has been a key trigger for the British lender to report its first loss in 26 years in its global operations.

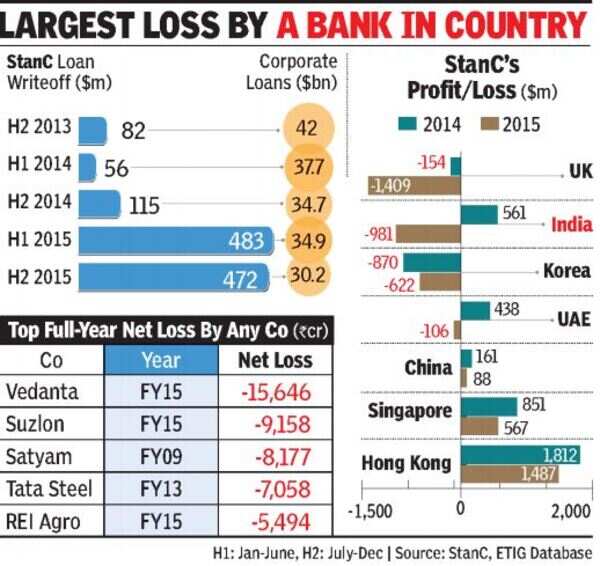

MUMBAI: A $1.3-billion (Rs 9,781-crore) hit taken by Standard Chartered Bank on its loans in India has been a key trigger for the British lender to report its first loss in 26 years in its global operations. The bank, which has its loans predominantly in Asia, reported a pre-tax loss of $1.5 billion (Rs 10,288 crore) for 2015, down from a profit of $4.2 billion (Rs 28,800 crore) last year.

StanChart, which is a lender to large corporate groups with exposure to commodities (like Essar), has reported a $981-million (Rs 6,728-crore) loss from its operations in India, down from a profit of $561 million in 2014.This is the biggest ever loss posted by a bank in India.

The impairment losses on loans in India were also the highest at $1.3 billion for StanChart - more than double of the $611-million hit it took due to credit losses in the UK.

The bank has also written down the value of its business in Thailand after placing Indonesia operations under review. It has cut down exposure in the commodities sector and has stopped executive bonuses.

The bank said it has reduced its target India exposure by 28% to $30.2 billion from $42 billion. "India and commodities represent a large proportion of the liquidation portfolio," the bank said. In a presentation to investors, the bank said India represented a high level of weak credit throughout the banking system despite high growth in GDP. It added that credit growth was the slowest in two decades and there was no appetite from local lenders to refinance the loans it wanted to offload.

The losses are part of the efforts of Bill Winters, the new CEO, to clean up the bank. "Our 2015 performance was poor, and in many ways unacceptable," said Winters, speaking to newspersons, forecasting another difficult year in 2016.

India was the largest contributor to StanChart's profits until 2010. The bank had bet big on India and was the only multinational entity to list here under the Indian Depository Receipts route in 2010.

On corporate and institution clients, the bank said that loan impairment increased significantly to $3.2 billion. "We have reviewed the portfolio extensively through 2015 and have increased provisioning, largely to reflect lower commodity prices as well as further deterioration in India," the bank said in its annual report.

The bank's share price were down nearly 6% at 409 pence in London - a year to date decline of more than 25%. Shares recovered after dropping 12% immediately after the results were announced.

StanChart, which is a lender to large corporate groups with exposure to commodities (like Essar), has reported a $981-million (Rs 6,728-crore) loss from its operations in India, down from a profit of $561 million in 2014.This is the biggest ever loss posted by a bank in India.

The impairment losses on loans in India were also the highest at $1.3 billion for StanChart - more than double of the $611-million hit it took due to credit losses in the UK.

The bank has also written down the value of its business in Thailand after placing Indonesia operations under review. It has cut down exposure in the commodities sector and has stopped executive bonuses.

The bank said it has reduced its target India exposure by 28% to $30.2 billion from $42 billion. "India and commodities represent a large proportion of the liquidation portfolio," the bank said. In a presentation to investors, the bank said India represented a high level of weak credit throughout the banking system despite high growth in GDP. It added that credit growth was the slowest in two decades and there was no appetite from local lenders to refinance the loans it wanted to offload.

The losses are part of the efforts of Bill Winters, the new CEO, to clean up the bank. "Our 2015 performance was poor, and in many ways unacceptable," said Winters, speaking to newspersons, forecasting another difficult year in 2016.

India was the largest contributor to StanChart's profits until 2010. The bank had bet big on India and was the only multinational entity to list here under the Indian Depository Receipts route in 2010.

On corporate and institution clients, the bank said that loan impairment increased significantly to $3.2 billion. "We have reviewed the portfolio extensively through 2015 and have increased provisioning, largely to reflect lower commodity prices as well as further deterioration in India," the bank said in its annual report.

The bank's share price were down nearly 6% at 409 pence in London - a year to date decline of more than 25%. Shares recovered after dropping 12% immediately after the results were announced.

End of Article

FOLLOW US ON SOCIAL MEDIA